The Bling card is becoming increasingly popular when it comes to teaching children how to handle money safely.

But what about the costs? From basic fees to optional fees for certain functions – in this article we will show you what costs are associated with the pocket money card and how they affect everyday family life.

This way you can quickly decide whether the Bling Card is the right choice for your child!

Bling Card costs: How much does the pocket money app cost?

The Bling Card is a practical prepaid card for children and young people that was specially developed to help them learn how to handle money safely. Parents can manage the card via an app and thus retain full control.

But what about the costs?

We have taken a close look at the current fees and prices (as of January 2025) so that you know exactly what to expect.

Basic fees: How much does the Bling Card cost as a subscription?

The Bling Card is not free, but offers flexible payment options that can be chosen depending on usage:

- Monthly fee: €2.99 per child, can be canceled monthly.

- Annual fee: €32 per child, with a discount of €3.88 compared to paying monthly.

Additional fees: What do I have to pay when using Bling?

In addition to the basic fees, additional costs may arise depending on how the card is used:

- First charge of the month: For free.

- Further credit card top-ups: 1.65% of the top-up amount.

- Replacement card: €9.99 if lost or damaged.

- Foreign currency fee: 2% of the transaction amount for payments outside the Eurozone.

- Manual payment of parental credit: €1 per transfer.

- Inactivity fee: Up to €30 per year if the card is not used for 10 months.

- Payment complaint: €25 per transaction.

- Garnishment fee: 25€.

Free services: Where is the Bling Card free?

Some services are already included in the price, so there are no additional fees:

- Cash withdrawals: Free of charge at ATMs at home and abroad (although ATM operators may charge fees).

- Issue of the card: Free with your first order.

- App usage: The app is free for both parents and children.

The Bling Card offers a variety of features specifically tailored to the needs of families.

With the ability to control spending and teach children about money management, it is a good choice for parents who value financial literacy. Although the costs are manageable, the additional fees, such as the inactivity fee or foreign currency fees, should be taken into account when making the decision.

Overview: All costs of the Bling Card (as of January 2025)

| Basic fees | ||

| Monthly fee | €2.99 per child | Can be canceled monthly. |

| Annual fee | 32 € per child | Corresponds to a discount of €3.88 compared to paying monthly. |

| Charges | ||

| First charge of the month | For free | Regardless of the method. |

| Further top-ups (credit card) | 1.65% of the amount | Only applies to credit card top-ups after the first. |

| Additional fees | ||

| Replacement card if lost | €9.99 | Will be charged for shipping the new card. |

| Foreign currency fee | 2% of the amount | Applies to payments and cash withdrawals in foreign currencies. |

| Manual payment of parental savings | €1 per transfer | When parents have funds paid out from their parent account. |

| Inactivity Fee | Up to €30 per year | Due when the card Not used for 10 months became. |

| Payment complaint | €25 per transaction | Costs for processing a complaint. |

| Garnishment fee | €25 per transaction | Due in the event of a legal seizure. |

| Free services | ||

| Cash withdrawals domestically and worldwide | For free | Free of charge, but you can ATM fees incurred by the operator. |

| App usage | For free | For parents and children alike. |

| Card issue | No fee | The first issue of the card is free of charge. |

| Notes | ||

| Foreign currency fees and ATM fees | Only apply to payments outside the Eurozone or depending on the ATM operator. | |

| Test phase | 14 days free | Bling Card can be tested before the first debit. |

Bling Card: How much does it cost to withdraw money?

With the Bling Card, children and young people can withdraw cash worldwide, without any additional fees from Bling itself.

However, there are a few important points that parents and users should keep in mind, as not all withdrawals are truly free.

Costs for domestic cash withdrawals:

- No fees from Bling: Bling does not charge any fees for withdrawals within Germany.

- ATM fees: Some ATM operators may still charge fees, which vary by location and provider. This is particularly common with independent machines.

Bling Card: Costs for cash withdrawals abroad

- Foreign currency fee: If cash is withdrawn in a currency other than euros, a foreign currency fee of 2% of the withdrawal amount to.

- Additional ATM Fees: Local ATM operators may also incur fees abroad, which will be displayed immediately before the withdrawal.

Restrictions and special features for cash withdrawals with the Bling Card:

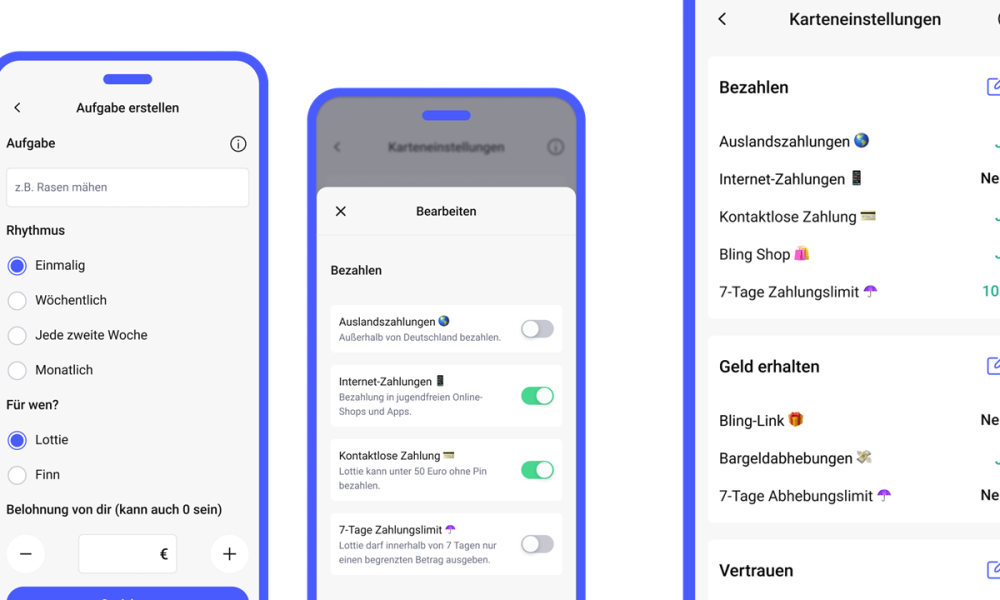

- App settings: Parents can use the Bling app to determine whether and how much cash can be withdrawn. This offers additional control over the children’s credit.

- Primarily for card payments: The Bling Card is primarily designed for cashless payment transactions. Although cash withdrawals are possible, they are not the focus of the card. In individual cases it could happen that withdrawals from certain ATMs are not supported.

The Bling Card itself does not charge any fees for cash withdrawals, but users should be aware that ATM operators can charge fees – both at home and abroad.

Anyone who withdraws in other currencies must also pay a foreign currency fee of 2% of the amount calculate.

Thanks to the app, parents can flexibly adapt usage and ensure that children learn how to handle cash and cashless payments.

Conclusion: Benefits of the Bling Card outweigh the costs

The Bling Card impresses as an innovative pocket money card that teaches children and young people how to use money responsibly. Despite the basic monthly fee and small additional costs, it offers numerous advantages that justify the price – especially for parents who value control, transparency and security.

The ability to track all spending in real time via the app, as well as the ease of topping up the card, make the Bling Card extremely user-friendly. At the same time, parents can set individual limits to ensure that their children’s expenses remain within limits. There are also numerous free functions, such as using the app or cash withdrawals free of charge (apart from possible ATM fees).

Of course, the Bling Card is not free, and there are fees such as the foreign currency fee 2% or costs for additional charging must be taken into account. Nevertheless, the price-performance ratio remains fair, especially compared to traditional banking products, which are usually less tailored to young users.

Overall, the advantages clearly outweigh the disadvantages: The Bling Card offers a practical solution for modern money management, can be used flexibly and gives parents the necessary control while children can gain their first financial experience. So if you are looking for a smart and secure pocket money card, the Bling Card is the best choice.

FAQ – Bling Card Costs

Is Bling free?

No, those Bling card is not completely free. While some services such as cash withdrawals and the use of the app are free, there are monthly fees and certain additional costs, such as: B. for replacement cards or foreign currency fees. However, there is one 14-day free trial periodwhere you can try out the Bling Card.

How much does Bling cost per month?

The monthly cost for the Bling Card is €2.99 per child. Alternatively, you can opt for annual payment, which €32 per year costs and therefore offers a small discount of €3.88 compared to the monthly payment.

For families who actively use the Bling Card, these fees are manageable and cover the administration and use of the app as well as many functions such as free cash withdrawals and card issuing

Which bank is behind Bling?

Behind the Bling card it stands Solarisbank AGa renowned bank from Germany that specializes in digital financial solutions.

Solarisbank is officially licensed and subject to supervision BaFin (Federal Financial Supervisory Authority). It provides the technical infrastructure and the German IBAN for the Bling Card. This guarantees that Bling works safely and according to German standards, which is particularly important for parents.

How much does the Bling card cost?

The Bling Card offers different models tailored to the needs of families:

- Bling base: For free. The basic functions such as app use and easy card top-up are included here.

- Bling Premium: For €2.99 per month Parents and children receive expanded functions. These include, for example: B. setting up Savings goalsmore detailed spending reports and even more control over the card.

- One-off costs: There is a fee for the physical Bling card 0 to 9.99 € depending on the model selected.

For parents who value control and transparency, the Premium model is ideal as it offers more features to teach children how to handle money safely.

Is Bling trustworthy?

Yes, the Bling Card is absolutely trustworthy. It will be in cooperation with the Solarisbank AG issued that meets all German safety standards. Bling also attaches great importance to data protection and security:

- All data is stored according to the EU General Data Protection Regulation (GDPR) protected.

- Parents have full insight and control over the use of the card at all times.

- A secure PIN code protects the card if lost or stolen.

Thanks to the partnership with Solarisbank, the German IBAN and the parental control options, families can use Bling without hesitation.