The Bling card is a prepaid card that was specially developed for children and young people to learn how to handle money safely.

It is primarily intended for cashless payment transactions, but also offers the option of withdrawing cash – both domestically and worldwide. Bling doesn’t charge any of its own fees, making it a flexible option.

Nevertheless, there are some special features and restrictions that parents and children should be aware of in order to avoid unnecessary costs.

Withdraw money with the Bling Card: Here’s how it works

The Bling Card makes handling cash easy and safe for children and young people.

Parents can retain control over transactions at all times. Whether in Germany or abroad – the prepaid Mastercard offers flexible options for withdrawing cash:

Instructions: Withdraw money with the Bling Card

- Select machine: The Bling Card works at all ATMs that accept Mastercard – and that’s over in Germany alone 58,000 machines.

- Insert card: Insert the Bling Card into the ATM card reader.

- Enter PIN: Enter the four-digit PIN the Bling Card. This PIN is set during card activation via the Bling app.

- Select amount: Select the desired amount. Make sure that the amount does not exceed the available credit on the card.

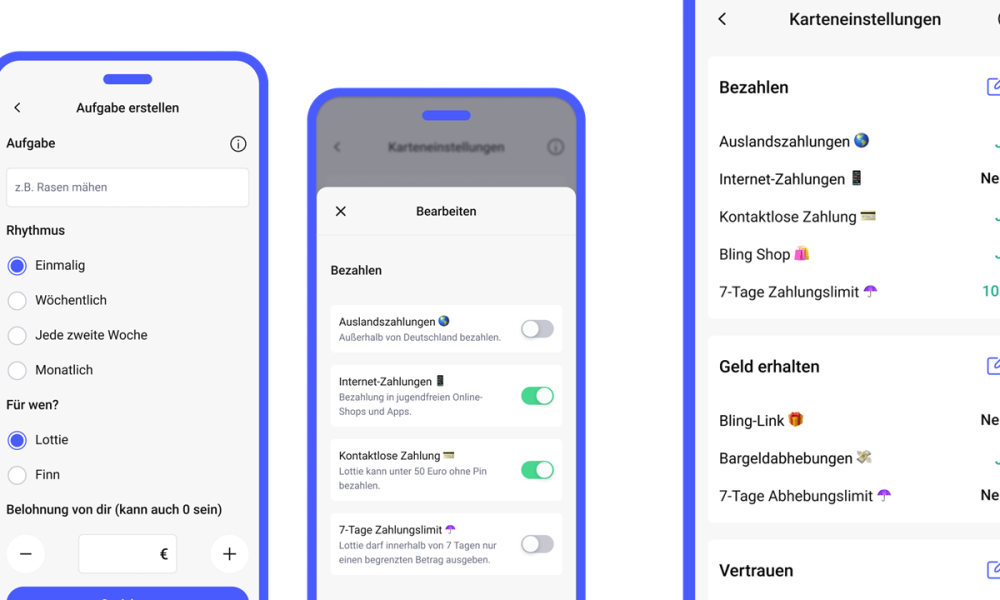

- Parents can in the Bling app Withdrawal limits establish. These limits determine how much money is available per withdrawal.

- Withdrawing cash: Once the transaction is complete, the machine dispenses the cash.

- Check receipt (optional): Some ATMs allow you to print a receipt to verify the transaction.

Withdrawing cash with the Bling Card is not only child’s play, but also safe. Thanks to the comprehensive control provided by the app, parents can ensure that their children learn how to handle money responsibly without losing track of things

Important information for parents and children:

- Control over the app: Parents can see when and where cash has been withdrawn at any time in the Bling app. This way everything remains transparent.

- ATM fees: Although the Bling Card itself does not charge fees for withdrawals, ATM operator fees may apply. These will be displayed before the transaction is completed.

- Foreign currency fees: For withdrawals in foreign currencies (outside the Eurozone) one applies Foreign currency fee of 2% of the withdrawal amount.

- Check balance: Make sure there are enough funds on the card to withdraw the amount you want.

Bling Card: How much does it cost to withdraw money?

With the Bling Card, children and young people can easily and flexibly withdraw cash from ATMs.

But what about the costs? The good news: The Bling Card does not charge its own fees for withdrawals. However, there are a few things to keep in mind to avoid unnecessary additional costs.

Costs for cash withdrawals with the Bling Card:

- Bling fees:

- In Germany: Drop it no fees when you withdraw cash from ATMs with the Bling Card.

- Abroad: Even abroad, Bling does not charge its own withdrawal fees, although there is a foreign currency fee.

- Foreign currency fees:

- For cash withdrawals in currencies other than euros, a Foreign currency fee of 2% of the withdrawal amount.

- For example, this fee applies to withdrawals in countries outside the Eurozone, such as the USA or Great Britain.

- ATM fees:

- Some ATM operators – particularly abroad – may charge additional fees for withdrawals. These fees will be displayed on the ATM screen before the transaction is completed.

- These costs vary by operator and country and are not reimbursed by Bling.

- Withdrawal limits:

- Parents can enter in the Bling app Withdrawal limit establish. This ensures that only a certain maximum amount can be withdrawn per transaction, which protects against misuse.

The Bling Card enables fee-free withdrawals in the Eurozone, but also offers a practical solution abroad – provided you are aware of the foreign currency and possible ATM fees.

Thanks to the ability to set limits in the app, parents and children can always keep track of costs.

This means that withdrawing cash with the Bling Card remains easy and secure

Overview: Costs for cash withdrawals

| Cost factor | Amount of the fee |

|---|---|

| Withdrawals in Germany | No fees through Bling |

| Withdrawals abroad (Eurozone) | No fees through Bling |

| Withdrawals abroad (foreign currency) | 2% foreign currency fee of the withdrawal amount |

| ATM fees | Variable, depending on the operator (displayed before transaction) |

Conclusion: Withdrawing cash with the Bling Card – simple, flexible and transparent

The Bling Card offers a convenient and safe way to introduce children and young people to handling money – even when cash is needed. With Fee-free withdrawals in Germany and the Eurozone it is a cost-effective solution for families. The ability to withdraw foreign currencies expands the scope of use, although there is one Foreign currency fee of 2% occurs.

Thanks to the transparent cost structure and the complete control over withdrawals With the Bling app, parents always stay informed and can control their children’s finances in a targeted manner. The option to set withdrawal limits to protect the budget is particularly practical.

In short: The Bling Card makes cash for families uncomplicated, secure and easy to plan – a modern financial tool that fits today

FAQ – Withdraw money with the Bling Card

Is Bling free?

No, those Bling card is not completely free. While some services such as cash withdrawals and the use of the app are free, there are monthly fees and certain additional costs, such as: B. for replacement cards or foreign currency fees. However, there is one 14-day free trial periodwhere you can try out the Bling Card.

How much does Bling cost per month?

The monthly cost for the Bling Card is €2.99 per child. Alternatively, you can opt for annual payment, which €32 per year costs and therefore offers a small discount of €3.88 compared to the monthly payment.

For families who actively use the Bling Card, these fees are manageable and cover the administration and use of the app as well as many functions such as free cash withdrawals and card issuing

Which bank is behind Bling?

Behind the Bling card it stands Solarisbank AGa renowned bank from Germany that specializes in digital financial solutions.

Solarisbank is officially licensed and subject to supervision BaFin (Federal Financial Supervisory Authority). It provides the technical infrastructure and the German IBAN for the Bling Card. This guarantees that Bling works safely and according to German standards, which is particularly important for parents.

How much does the Bling card cost?

The Bling Card offers different models tailored to the needs of families:

- Bling base: For free. The basic functions such as app use and easy card top-up are included here.

- Bling Premium: For €2.99 per month Parents and children receive expanded functions. These include, for example: B. setting up Savings goalsmore detailed spending reports and even more control over the card.

- One-off costs: There is a fee for the physical Bling card 0 to 9.99 € depending on the model selected.

For parents who value control and transparency, the Premium model is ideal as it offers more features to teach children how to handle money safely.

Is Bling trustworthy?

Yes, the Bling Card is absolutely trustworthy. It will be in cooperation with the Solarisbank AG issued that meets all German safety standards. Bling also attaches great importance to data protection and security:

- All data is stored according to the EU General Data Protection Regulation (GDPR) protected.

- Parents have full insight and control over the use of the card at all times.

- A secure PIN code protects the card if lost or stolen.

Thanks to the partnership with Solarisbank, the German IBAN and the parental control options, families can use Bling without hesitation.

Can I also withdraw money with the Bling card?

Yes, children and young people can use the Bling card withdraw cash from ATMsas long as the machine supports Mastercard. Parents can activate cash withdrawals and set limits in the Bling app. Falling in the process no fees for withdrawals in euros, although ATM operators may charge their own fees.

Which bank is Bling?

The Bling card is not issued by a traditional bank, but by Bling appan innovative fintech provider that specializes in teaching children how to manage money. There is a transparent system behind the card that parents and children can easily use.

Can you withdraw money from an ATM with a credit card?

Yes, the Bling card works like a prepaid credit card from Mastercard. She can do it all Mastercard-enabled ATMs worldwide be used to withdraw cash. However, the limits set by parents in the app as well as a Foreign currency fee of 2% for withdrawals outside the Eurozone.

Where is the Bling Card accepted?

The Bling card will Accepted worldwide wherever Mastercard is used. Whether in shops, restaurants or online – the card works flexibly and securely. It is ideal for everyday life and also suitable for traveling abroad.

How can I withdraw my Bling Points?

Bling points cannot be withdrawn directly as they are not cash. Instead, Bling points can be used in the app for reward-based promotions or redeem certain purchases. The Bling app provides further information.

Can you pay with the Bling card on Amazon?

Yes, the Bling card can be used on Amazon without any problems. Since it works as a Mastercard, it can be stored as a payment method. When making a purchase, the amount is deducted directly from the card’s balance, so there are no additional fees.